Conclusion and Implications A moving average convergence-divergence (MACD) is a concept based on a combination of three exponentially smoothed moving averages. The concept of convergence and divergence is seen in technical analysis when a technical analysis tool could not estimate an accurate direction of the market movement Terminology The Convergence and Divergence of two moving averages are what MACD implies. If moving averages move towards each other, it means that a Convergence is occurring. On the other hand, a divergence occurs when (5) Moving Average Convergence blogger.com - Moving Average Convergence Divergence(MACD MACD(moving average convergence\/divergence is a technical (5) Moving Average Convergence blogger.com - Moving SchoolCalifornia State University, East Bay Course TitleFIN Uploaded Bypuckgao Pages5

MACD - Moving Average Convergence Divergence Free PDF Guide

edu no longer supports Internet Explorer. To browse Academia. edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser. Log in with Facebook Log in with Google. Remember me on this computer.

Enter the email address you signed up with and we'll email you a reset link. Need an account? Click here to sign up. Download Free PDF. MACD -Moving Average Convergence Divergence Trading Guide. Melvin Macutong. Download Download PDF Full PDF Package Download Full PDF Package This Paper. A short summary of this paper. PDF Pack. People moving average convergence divergence pdf downloaded these PDFs.

People also downloaded these free PDFs. Untuk kalangan sendiri by Bijak Sufi. Download Free PDF Download PDF Download Free PDF View PDF.

Gain Comparison between NIFTY and Selected Stocks identified by SOM using Technical Indicators by IOSR Journals, moving average convergence divergence pdf. Candlestick and Pivot Point Trading Triggers Setups for Stock, moving average convergence divergence pdf, Forex, and Futures Markets by Malcom Laurence. View PDF. Matematika Pasar Modal "Moving Average Convergence Divergence MACD " by Ethan Moving average convergence divergence pdf. Trend Trading for a Living This page intentionally left blank Trend Trading for a Living Learn the Skills and Gain the Confidence to Trade for a Living by Michael Martin.

Download Download PDF. Download Full PDF Package. Translate PDF. MACD — Moving Average Convergence Divergence Trading Guide Oscillating indicators are to show securities when they are overbought or oversold allowing a trader to enter at the best possible price. In this guide we are going to concentrate on the MACD and how to combine with other strategies to enhance a trading strategy.

What is MACD? MACD fluctuates above and below zero lines, highlighting both momentum and moving average convergence divergence pdf direction as the moving averages converge and diverge.

You can use closing price for this moving average. The 9-day EMA acts as a signal line and identifies turns because it is plotted with the indicator. For the histogram, it represents the difference between MACD and its 9-day EMA Signal Line. If the MACD line is above its Signal Line then its positive and if the MACD line is below its Signal Line, then it is negative.

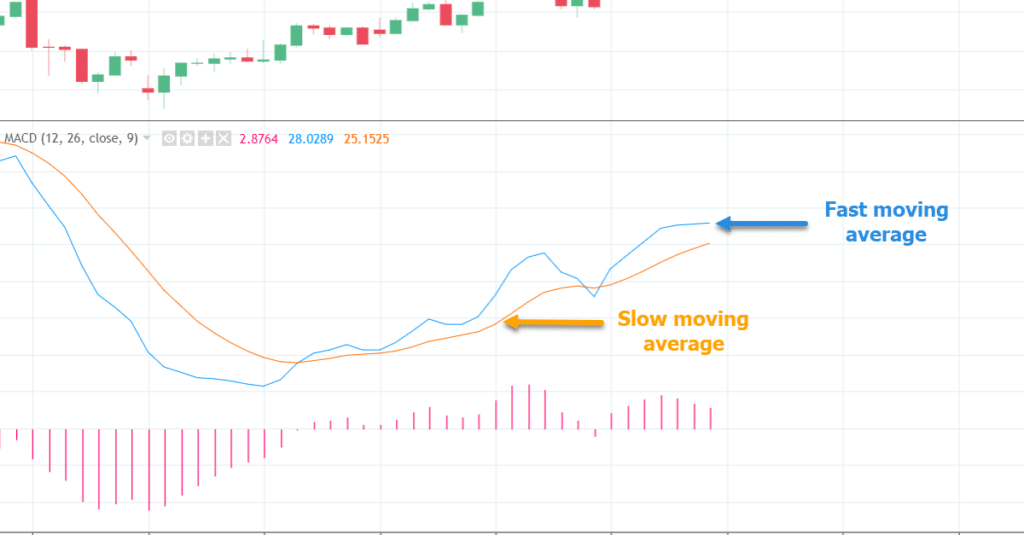

You can substitute other values depending on your preference and goals. How to Trade Using MACD MACD has two moving averages with different speeds. If a new trend occurs, the fast line will start to cross the slower line.

For this reason, the fast line will diverge or move away from the slower line, often indicating a new trend. You can see in the image above that when the lines cross, the histogram temporarily disappears because the difference between the lines at that time is 0. Terminology The Convergence and Divergence of two moving averages are what MACD implies. If moving averages move towards each other, it means that a Convergence is occurring.

On the other hand, a divergence occurs when the moving averages move away from each other. There are three different methods to interpret Moving Average Convergence Divergence MACD. It trails average line and helps determine the turns in the MACD. It shows bullish crossover when the MACD crosses above the signal line, and a bearish crossover if it turns below the signal line.

As shown above, the chart clearly shows how a buy entered after the bullish crossover can be profitable. This strategy can also be used to manage or close a short entry. This occurs when the day EMA moves above the day EMA. If the MACD line moves below the zero line to turn negative, then it is a bearish center-line.

This occurs when the day EMA moves below the day EMA. Divergence If the security price diverges from the MACD, moving average convergence divergence pdf, it is a signal of a potential new trend. This shows a point where the MACD does not follow price action and deviates, moving average convergence divergence pdf. What is the Most Popular MACD Combination?

In fact, the basic point of combining these tools is to match crossovers. If it occurs, you buy or sell the equity and hold your position until the MACD gives you a signal to close the position.

It illustrates that there are two short and one long setups that occur after a crossover between the MACD and the RVI. The green circles are crossovers moving average convergence divergence pdf the red circles are where the position should have been closed.

It generates less buy and sell signals compared to other oscillators, for the reason that the money flow index requires both price movements and surge to make extreme readings. If the MFI gives you a signal of a bearish cross over the MACD lines, there is a potential short trade. This strategy is the same way in the opposite direction for long trades.

The chart above is the minute chart of Bank of America BAC, moving average convergence divergence pdf. The green circle is the moment when the MFI is signaling that BAC is oversold. After 30 minutes, moving average convergence divergence pdf, the Moving average convergence divergence pdf has a bullish signal and is now open for a potential long position at the green circle highlighted on the MACD.

You hold your position until the MACD lines cross in a bearish direction as shown in the highlighted red circle on the MACD. To sum up, this position lets you profit an amount of 60 cents per share for about 6 hours.

It is made up of a single exponential moving average, a double exponential moving average, and a triple exponential moving average. It can generate a trade signal when the fast line crosses the MACD and the price of a security breaks through the TEMA.

You will exit positions whenever you receive contrary signals from both indicators. The image below is the minute chart of Twitter. In its first highlighted green circle you can clearly see that you have the moment when the prices switch above the period TEMA.

The MACD confirms a bullish TEMA signal on the second highlighted circle. This is when you open your long position. As shown above, the price increases and you get your first closing signal from the MACD in about 5 hours. The price moving average convergence divergence pdf twitter breaks the period TEMA in a bearish direction after 20 minutes and you close your position.

As can be seen, it generated a profit of 75 cents per share. It is an oscillator used to identify oversold and overbought markets. This strategy offers two options for exiting the market. This gives you the moving average convergence divergence pdf and more secure exit strategy. You exit the market right after the trigger line breaks. This strategy is riskier because if there is a significant change in trend, you are in your position until the zero line of the TRIX is broken, moving average convergence divergence pdf.

It could take a while for that to happen. The image above shows the minute chart of eBay. As shown above, the first green circle is a long signal that comes from the MACD. The second highlighted green circle is when the TRIX breaks zero and you enter a long position.

On the other hand, the two red circles show contrary signals from each indicator. In the first case, the MACD gives you the option for an early exit, while in the second case, TRIX keeps you in position. By using the first exit strategy, you would have gained a profit of 50 cents per share, while the alternative approach will generate a profit of 75 moving average convergence divergence pdf per share.

The Awesome Oscillator calculates the difference of the 34 and 5-period Simple Moving Averages, moving average convergence divergence pdf.

You will enter and exit the market only when you receive a signal from the MACD, confirmed by the awesome oscillator. Below is the minute chart of Boeing. The two highlighted green circles are signals that indicate to open a long position. The Awesome Oscillator gives you a contrary signal after going long. Yet, the MACD does not produce a bearish crossover, so you stay with your long position. The first red circle highlights when the MACD has a bearish signal.

The second red circle highlights the bearish signal generated by the AO and you close your long position. Recap The best thing about the MACD indicator is that it brings together momentum and trends into one indicator.

As has been noted, you can calculate it by using the difference between two moving averages. All the success! Learn Price Action.

3.2 Moving Average Convergence Divergence (MACD)

, time: 8:20

(5) Moving Average Convergence blogger.com - Moving Average Convergence Divergence(MACD MACD(moving average convergence\/divergence is a technical (5) Moving Average Convergence blogger.com - Moving SchoolCalifornia State University, East Bay Course TitleFIN Uploaded Bypuckgao Pages5 Conclusion and Implications A moving average convergence-divergence (MACD) is a concept based on a combination of three exponentially smoothed moving averages. The concept of convergence and divergence is seen in technical analysis when a technical analysis tool could not estimate an accurate direction of the market movement Moving Average Convergence-Divergence (MACD) was originally constructed by Gerald Appel an analyst in New York. Originally designed for analysis of stock trends, it is now widely used in many markets. MACD is constructed by making an average of the difference between two moving averages

No comments:

Post a Comment